The retail banking landscape is changing dramatically, fueled by shifting consumer behavior, digital acceleration and an increased focus on customer experiences and technology-driven solutions. Banks are faced with the challenge of seamlessly integrating their branches, mobile applications and call center systems and creating true omnichannel experiences. Through high-performance low-code development platform, OutSystems for digital banking can help banks stay competitive and differentiate themselves in today’s modern digital world.

In this blog we will discuss various digital banking challenges and how OutSystems banking solutions solve those challenges.

Digital banking challenges and OutSystems capabilities to rectify them

Impacted with the high agility in the market and diversity in the expectations customers demand, the banking industries face disruption in adopting the emerging sustainable technology. Here are some significant challenges & banking solutions that help to drive transformation successfully:

#1. Delivering personalized banking experience

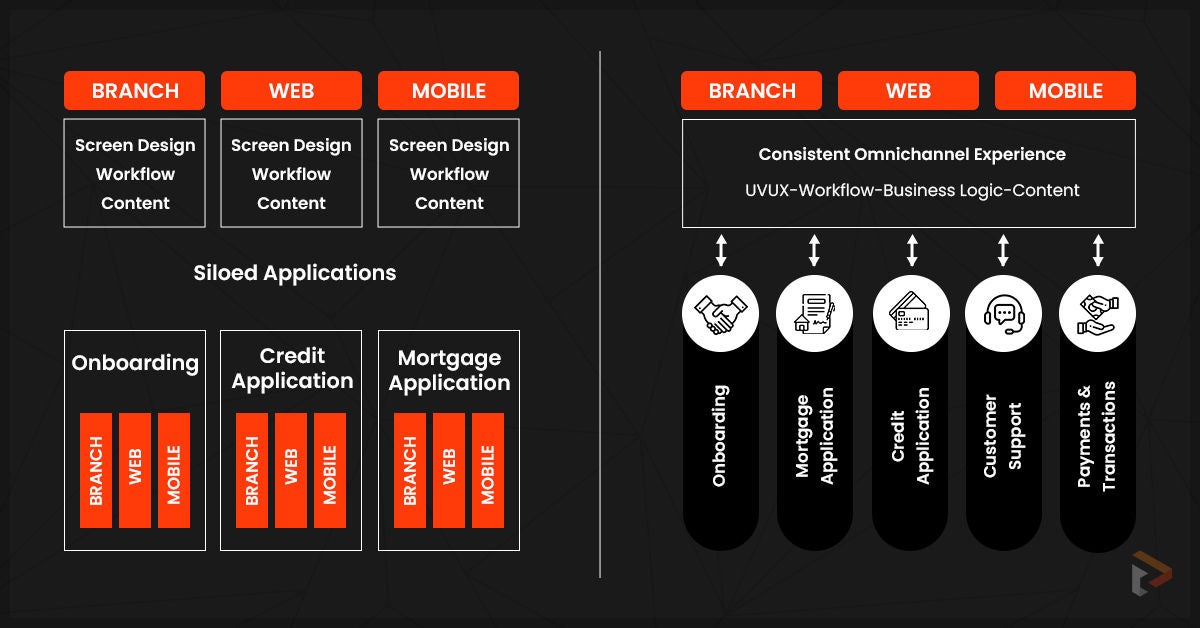

Customers expect their banks to offer the same flawless real-time user experience they witness in other industrial genres. The BFSI industry faces data silos oriented around products rather than a customer’s journey. As a result, the development of a true end-to-end customer-centric omnichannel banking experience becomes a challenge.

How OutSystem helps:

- OutSystems UI framework provides UI patterns with beautiful built-in responsive screen templates for web and mobile. With these, you can easily incorporate Screen Templates into your applications according to business requirements. In the banking industry, you can choose branch locators, dashboards, and request management templates.

- With OutSystems full-stack capabilities to customize the UI of applications and Theme Editor features allows you to customize the overall style of the application.

- OutSystems Experience Builder allows you to create and test prototypes in hours and generate production ready-code with experience and development best practices built-in minutes. With its built-in native behaviors and animations, the OutSystems platform ensures seamless banking applications.

- Banks can utilize OutSystems device syncing capabilities, available in Forge to track customer journeys and provide personalized solutions. For example, when the customer decides to pause their application process on one device and wish to pick up the process on another device, your internal employees can see where the customer left off and re-engage with the prospect to help them complete the rest of the application process.

#2. Lack of digitalization in banking customer service

Banks are still on paper for some critical workflows and using manual data entry, legacy processes, and course of action, ruining their ability to reduce costs, provide consistent data in real-time, streamline operations, and deliver innovative solutions to their customers. To provide a seamless customer service experience, banks need to orient their processes around the customer journey.

How OutSystem helps:

- OutSystems Case Management Framework (CMF) helps build apps that allow digital innovation by transforming complex banking processes and efficiently managing cases like loans, regulatory compliance, incident management, KYC, etc.

- With pre-built capabilities like process auditing and collaboration, SLA management banking organizations can break down data silos and align architecture by delegating, blocking, escalating, or scheduling tasks.

- As the platform is a full-stack enterprise development platform, it empowers banks to build applications that address every use case, from omnichannel customer experience to rebuilding an entire core banking system.

- OutSystems Workflow Builder auto-generates professionally designed, frictionless user experiences by building and publishing internal productivity applications with a single click.

#3. The escalating costs and depleting performance levels of legacy systems

With decades of customization, customer data, and investments locked into monolithic systems, banks are tied to them for the future. The legacy systems are prone to inhibiting banking application development and delivery. The hand-wired business logic and rigid transactional interfaces don’t allow quick extensions, and some applications deliver zero flexibility. Because of the monolithic nature, many banking applications find it difficult to be agile enough to meet the needs of their customers.

How OutSystem helps:

- The OutSystems visual development environment increases development speed by as much as ten times. Organizations either already agile or want to adopt agile methodology can quickly iterate to keep pace with changing customer needs or regulatory pressures.

- With the integration capabilities of OutSystems, you can connect applications to all of your banking systems, and real-time decisions can be made between the back office and the customer so that your customer has an account decision in a matter of minutes.

- With the OutSystems platform, banks can track the customer experience for a critical 360-degree view of the customer. This allows the bank to provide automated messages and actions based on previous usage or transactions made by the customer.

- By building customer service portals and mobile applications using OutSystems, banks make it easy for customers to view and amend personal information, view transactions, initiate payments, and set up and manage alerts on their account activity.

#4. Disparate data silos

Customers prefer information that is not repetitive for products and transactions with the banks they have given once. But banks using traditional systems find it difficult with data silos and disparate systems. The lack of data exchange between different departments of banks can harm operational efficiency and, in the end, customer experiences.

How OutSystem helps:

- With the power of low-code, OutSystems provide banks a way to move from COTS (commercial-off-the-shelf) tailor-made to the banks and customer needs.

- OutSystems can transform the support process from a siloed communication channel that reacts to customer requests to a proactive omnichannel experience designed expressly for customers needs.

- Banks can develop mobile applications with OutSystems to easily integrate an appointment scheduler that allows users to schedule an in-branch appointment on the web or mobile device that the bank branch manager can pick up, making communication easier and breaking down silos.

#5. Staying compliant and secure with the pace of innovation

The banking industry faces constant challenges in staying compliant and secure with customers' information. The banking applications need to be built with enterprise-grade security. Considering that customers' demands are increasing with the pace of innovation, there is a substantial impact on risk management for banks slowing down productivity.

How OutSystem helps:

- OutSystems Sentry sets a higher standard for extensive security built-in to protect the entire application lifecycle. The additional security is specifically designed for organizations like banks dealing with sensitive customer data.

- OutSystems AppShield makes your apps resilient and resistant to tampering and reverse engineering, making it impossible for hackers and cybercriminals to meddle against security control.

- AppShield and Sentry are both capabilities of the OutSystems platform to protect sensitive information like financial transactions, passwords, and account information. This can be minimized by encrypting all sensitive information and disabling data storage.

#6. Customer onboarding with accelerated time-to-market

Customers want to experience the same convenience in banking as they do in digital lifestyle applications. Banks have been using traditional off-the-shelf solutions for onboarding customers for account opening, loan approvals, pending transactions, etc., which makes it challenging to customize and improve their digital services on time.

How OutSystem helps:

- OutSystems enables a bank to develop a fully digital onboarding process on multiple platforms that customers can use to integrate into any third-party system. This makes user authentication easier by text message, photo ID, automated ID verification with pre-built integration into the KYC solutions, and links to verify an email address.

- OutSystems rapid application development allows you to build scalable applications faster that are also highly reliably according to your business requirements.

- The low-code platform OutSystems intelligent workflow capabilities and pre-populated data in forms to reduce the application process, significantly increasing customer satisfaction and reducing the abandonment rate drastically.

#7. The crunch of resources

The banking industry previously outsourced processes to make it efficient, incurring high costs. Outsourcing reduces the visibility of operations procedures, making it risky to compliance with GDPR(General Data Protection Regulation) protocols.

How OutSystem helps:

With OutSystems, you can create digital banking applications in a matter of weeks using a single code base. You can create the base of an application once and then customize it for other devices in just hours, cutting down the development time and reducing the costs of resources. This enables you to provide your customers with a consistent experience in viewing your products or services.

Discover how we assisted Orient Commercial Bank (OCB) in developing a state-of-the-art mobile banking app to deliver superior experience to its corporate users.

Why is OutSystems for digital banking the right choice?

With retail banks facing constant challenges in their digital strategy, the technological decisions banks will make have a major effect on the BFSI industry. Banks need to have robust digital transformation strategy and to help OutSystems banking solutions build applications to meet the ever-evolving needs of customers and provide frictionless experience.

Let’s discuss how banks can create customer-centric applications and transform the banking experience: