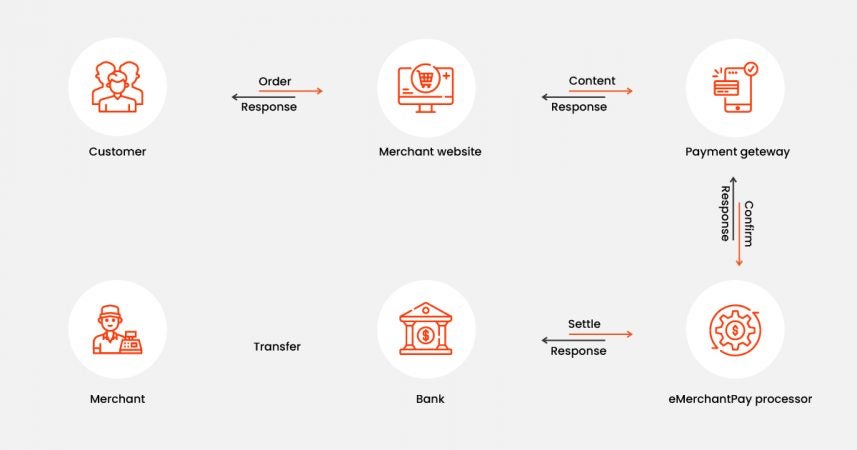

- Customer places an order on an eCommerce site and proceeds to the checkout page to confirm the order details and make the payment.

- The customer enters the card details or other details based on the selected mode of online payment, securely via the SSL (Secure Socket Layer) encryption.

- The online platform forwards this payment request to the designated eCommerce payment gateway via an encrypted connection to its hosted payment server.

- This transaction request is then passed to the payment processor of the retailer’s acquiring bank.

- This request is then forwarded to the issuing bank for authorization of the customer details and the received response is reverted to the processor with an approval or denial response code.

- The response received by the processor is passed to the payment gateway, and the order fulfillment begins if the transaction is approved.

- Once the order is processed, these steps are repeated to clear the authorization from the acquiring bank.

- All such authorizations are submitted in a batch to the acquiring bank at the end-of-day, and the bank makes a batch settlement request, which is processed in 24 hours, and the money is deposited in the merchant’s bank account.

Types of payment gateways

The choice of payment gateways depends on the convenience of customers visiting the eCommerce store and buying products by doing online transactions. It is important to study the customer buying behavior and understand the Payment Card Industry (PCI) compliance and Data Security Standards (DSS) before selecting the best payment gateway for eCommerce platforms.

Following are the two types of payment gateway solutions that can be used by online merchants to accept payments from their customers.

#1: Externally hosted payment gateway

External payment gateway solutions redirect customers from the merchant’s site to a payment processor platform, where customers can enter their transaction-related information for processing their orders. The external payment gateway provider is responsible for PCI DSS compliance and all the security measures that have to be taken care of while handling online transactions. These payment gateways need no customizations and are fairly easy to set up.

A classic example of an external payment gateway is PayPal. When customers want to place an order on an eCommerce site using PayPal, they are directed to the PayPal site to process the payment. Once the payment is authorized, the customers return to the eCommerce site and complete the checkout process.

Hosted payment gateways are usually suitable for small and local businesses as it helps them focus on retailing rather than performing additional activities such as compliance checks, security checks, and data encryption. The most popular payment gateways in this category are Kalrna, Payza, and Worldpay.

#2: Integrated payment gateway

Having an integrated payment gateway allows merchants to have complete control over the checkout process of their customers. However, they are also responsible for maintaining PCI DSS compliance and securing all the transaction information. With these payment gateway solutions, customers are not directed to a third-party website; to complete their payments. They can accomplish an end-to-end order fulfillment on the merchant’s site only.

The integrated eCommerce payment gateway solutions give an enriching, friction-free, pleasant, and seamless shopping experience to the customers as they never leave the online shopping platform. The most popular payment gateways in this category are Stripe, Authorize.net CIM, and WePay that seamlessly integrate with eCommerce platforms like Shopify, WooCommerce, BigCommerce, and more.

How to choose the best payment gateway for an eCommerce store?

Choosing the right payment gateway is crucial for online businesses to provide an enjoyable shopping experience to their customers and increase their revenue and sales in return.

Below are 8 parameters to consider when selecting a payment gateway for an eCommerce store.

#1: Pricing

Merchants should choose the best payment gateway for their online store, but they should also consider the cost associated with various payment platforms. Payment gateway solutions have predefined charges, such as setup fees, annual maintenance charges, integration fees, commissions, transaction fees, and subscription fees amongst a few. Thus, while choosing a payment gateway for an eCommerce store, merchants should carefully look for any hidden charges that might be levied upon them and avoid selecting an expensive eCommerce payment gateway.

#2: Security

Transaction details entered by customers on hosted or integrated payment gateways is sensitive information, thus, digital security must top the priority list of business owners when choosing a payment gateway solution. Selecting a secure payment gateway is essential for reducing cart abandonment rates and building trusted relationships with customers. Online businesses should opt for PCI DSS compliant and GDPR compliant payment gateways to protect their customers from eCommerce frauds such as identity theft, phishing, and credit card frauds.

#3: Multiple currency support

Businesses that cater to customers worldwide must ensure that the payment gateway supports multiple currency transactions. Offering global payment solutions helps brands scale their customer reach and generate brand awareness on a large scale. An international payment gateway empowers eCommerce stores to fulfill orders from different countries. It also enables their customers to pay in their local currency and help them avoid foreign currency transaction fees.

#4: Multi-device payment support

An omnichannel shopping experience allows customers to buy a product anywhere using any digital device. So, it is important to select a payment gateway that supports multi-device payments and enhances the online purchasing experience of customers by giving them the flexibility to carry out online transactions and easy checkouts on all devices and network types.

#5: Ease of integration

The payment gateways should have a plugin to integrate with CMS and SDK libraries to start the payment acceptance process. Business owners should consult a technical team to understand the limitations and capabilities of the integration process. Also, the integration of a payment gateway should not hinder the UX of the website or make the payment process slower. Payment gateways should be easily configurable with an eCommerce platform and provide integration assistance with top-notch security.

#6: Recurring payment option

A recurring payment model like Amazon Prime enables retailers to set up an automated payment cycle for their customers. Payment gateway solutions should come with an option to facilitate retailers to offer periodic payment plans (subscription-based business model). Payment gateways should be able to save and reuse the transaction details of eCommerce customers for automatic debit as per their subscription plan.

#7: Customer support

A payment gateway should provide 24×7 customer support via various channels such as raising tickets, call support, emails, automated chatbots, and live technical support. Customer support is an important part of eCommerce customer engagement that builds brand loyalty among customers. Quality customer support reduces the average response/resolution time and increases customer satisfaction. Online business platforms should choose payment gateway solutions that offer secure and convenient customer support services.

#8: Product specifics

Some payment gateways have limitations when it comes to selling specific products and services. Also, there are a few high-risk business models that are not supported by some payment gateway solutions. Business owners should check this list on the payment gateway’s site before going through the hassle of incorporating a payment gateway for their eCommerce business. Some businesses considered as high-risk include:

- Tobacco

- Gambling

- Forex

- Dating

- Gaming

Exploring the best payment gateway for eCommerce

The best payment gateway for eCommerce stores is the one that offers a secure shopping experience to customers and seamless integration with the online business platform. Payment gateways should enable customers to do online transactions with ease and empower retailers to accept digital payments globally. After all, a good checkout and payment gateway experience is crucial for customer retention. Our competitive partnerships with leading payment providers like Atome,